Foundations

Security, Returns, and Diligence

At the core of Capital Prime’s enduring success is a meticulously crafted investment

strategy anchored in four fundamental pillars

Ensuring security and capital

preservation

Reducing risk

Upholding a stringent due

diligence process

Delivering consistent returns

alongside regular cash flow

Successful investing is about managing risk, not avoiding it.

Benjamin Graham

Our commitment to these principles has established us as a leader in the Canadian mortgage industry, offering mortgage investment opportunities designed for sustained, attractive returns through a conservative and judicious investment philosophy.

Targeted Investment Focus

Our investment focus is on short-term, primarily residential mortgages in first position, backed by solid economic underpinnings and capped at an average loan-to-value (LTV) ratio of 65%-80% to curb volatility.

MIC portfolio is diversified across various dimensions—geographical regions, borrowers, mortgage types, and durations—all secured by real estate collateral, minimizing overhead and maximizing returns for our investors.

Steady growth conservative asset management for steady growth

Capital Prime leverages its deep industry expertise to foster investments characterized by steady performance and conservative asset management. Our Mortgage Investment Corporation (CPMIC) embodies our commitment to capital preservation and strategic diversification, guided by a seasoned management team that oversees every aspect of the mortgage lifecycle.

This comprehensive oversight allows us to maintain low operational costs, thereby enhancing investor yields.

Built on Prudent Principles

A Foundation Built on Prudent Principles

Capital Prime’s track record of success is built upon five key principles that define our operational ethos:

Prudent Investment Philosophy: We specialize in short-term mortgages, offering solutions that prioritize capital preservation, stability, and sustainable, attractive yields. Our focus is on serving qualified borrowers who might not fit within traditional banking criteria.

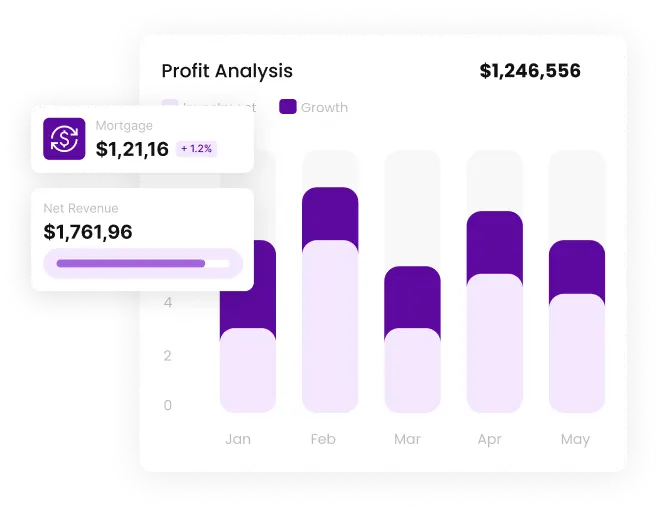

Consistent, Compelling Returns: Our rigorous due diligence and active management, combined with extensive mortgage industry experience, position our MIC as a compelling alternative to traditional fixed income, historically delivering net annual yields between 7% and 16%.

Efficient Expense Management: By sourcing mortgage assets internally and managing fund operations in-house, we significantly reduce expenses, translating to lower fees and higher net returns for our investors.

Active Risk Mitigation Strategy: Capital preservation is paramount, achieved through investing in stable, growth-oriented real estate markets, diversifying mortgage portfolios, adhering to strict origination guidelines, and conservative property valuations by skilled appraisers.

Consistent, Compelling Returns: Our rigorous due diligence and active management, combined with extensive mortgage industry experience, position our MIC as a compelling alternative to traditional fixed income, historically delivering net annual yields between 7% and 16%.

We don't have to be smarter than the rest; we have to be more disciplined than the rest.

Warren Buffett

Smart Lending Practices: Our lending is focused on Canadian residential markets with robust economic fundamentals, ensuring stability and growth.

Flexibility and Security

Capital Prime MIC Fund is accessible through registered securities dealers and EMDs, with a straightforward qualification process and a minimum investment threshold of $5,000. Flexible investment options include cash or registered funds through a qualified trustee. Furthermore, our funds offer penalty-free redemptions after 12 months,